Global overview

Sales of consumer durables forecast to slow

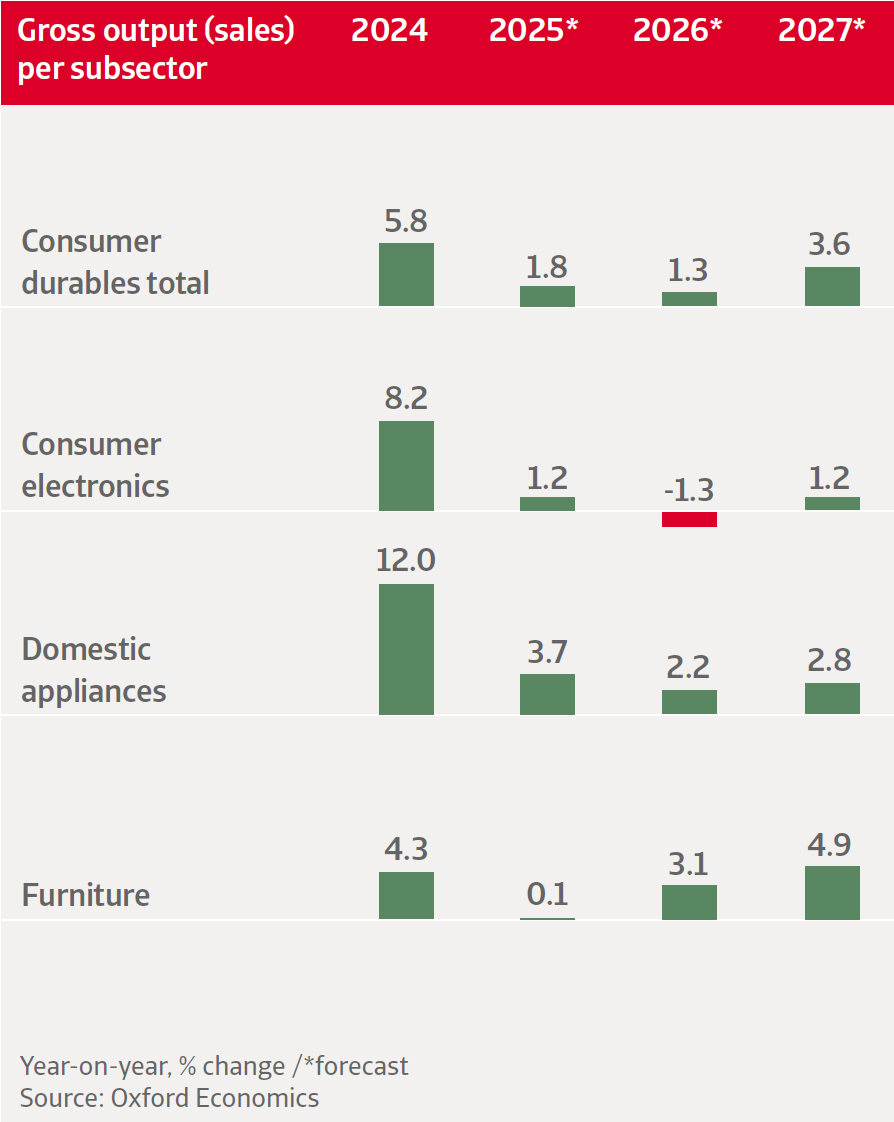

After increasing by 5.8% in 2024, global sales growth of consumer durables is forecast to slow down to 1.8% in 2025 and 1.3% in 2026. Next year´s expansion will be mainly driven by the US and emerging markets except China.

%20per%20subsector%20-%20Consumer%20durables%20October%202025.2025-10-24-13-28-03.png)

Currently the most imminent threats are the increased use of trade tariffs and protectionism. Tariffs weigh on economic growth directly through higher costs of trade, which in turn often results in increasing consumer prices and a reduction in disposable household income.

The credit risk of consumer durables retailers in many advanced markets remains elevated, with smaller players especially vulnerable to defaults and insolvency. The sector operates in a fiercely competitive environment with thin margins.

United States

Solid growth outlook in 2026, but tariffs threaten supply chains

We expect US consumer durables sales to contract by 1.1% this year, with consumer electronics and domestic appliances decreasing by 3.3% and 2.2% respectively.

Meanwhile spending has gained momentum again, and in 2026 consumer durables is forecast to grow 3.2%. Household spending should be supported by further interest rate cuts and personal tax cuts.

However, this is mainly driven by higher income households, while spending among low-income consumers is under pressure due to a weaker labour market and lower benefits from tax cuts. That bifurcation in will persist and deepen.

In the mid-term tariffs threaten to disrupt established supply chains and product availability, while consumers could cut back purchases because of higher prices. The US sources a large part of domestic appliances, consumer electronics and furniture from Asia, in particular China.

Retailers will be forced to pay the tariffs, either by absorbing it, passing it on to consumers, or a combination of both. In general larger retailers are in a better position to deal with the situation than smaller companies, which are often less able to build up large inventories and switch suppliers at short notice.

China

Impact of government support for consumer durables sales is waning

In order to boost consumer spending, last year the Chinese government introduced a domestic trade-in programme for passenger cars, household appliances and consumer electronics.

This led to a boost in consumer durables sales in late 2024 and early 2025. However, the momentum from the programme is about to fade, and we expect consumer durables sales growth to slow down to 0.6% in 2026.

Chinese consumer sentiment remains volatile, mainly due to the ongoing issues in the property sector, where home buyers are confronted with negative wealth effects due to price pressures. Deflation risks still persist which may lead to further demand erosion.

Chinese furniture manufacturing is set to contract by 4% in 2025 and by 1% in 2026. US tariffs are weighing heavily on home goods exports, which decreased by more than 21% in July. This has prompted Chinese factories to cut shifts, reduce wages, and relocate some production to Southeast Asia.

India

Ongoing growth and good long-term prospects

Household spending in India will remain robust in 2025 and in 2026, supported by monetary easing and a large consumption tax cut, which covers more than 400 items.

The long-term outlook for consumer durables remains positive due to increasing household purchasing power and a growing middle class.

Japan

Low consumer confidence weighs on the sector

After an 8.7% decline in 2024 we expect consumer durables sales in Japan to rebound by only 0.9% in 2025 and to level off in 2026. Households' purchasing power has weakened.

There will be moderate gains in real incomes, but the lagged impact of currently-low confidence will avoid a comprehensive recovery in the short-term. In the long run, the ageing and declining population size will mean weaker consumption prospects.

France

Credit risk remains high in the retail sector

We expect the performance of French consumer durables to remain subdued in 2025 and in 2026, with sales contractions of 1.6% and 0.9% respectively. French households are spending less due to lack of confidence in the future.

Credit risk in the retail segment remains elevated. Inventories are quite high due to low levels of demand, and financial partners are increasingly restrictive with short-term facilities. Margins are generally low across all subsectors.

The level of payment delays and insolvencies is high among smaller retailers. Large, specialised retailer groups are financially more healthy, as they keep on gaining market share.

Germany

Growing sales amid increased payment delays and insolvencies

After a 2.8% contraction in 2024, consumer durables sales in Germany are expected to rebound by 0.6% in 2025 and to grow by 1.6% in 2026. Slowing inflation supports real income gains and falling deposit interest rates may limit the degree of precautionary savings.

The credit risk in the German retail segment remains elevated. Input costs for retailers remain high, credit is still expensive and margins are very thin. The level of payment delays and insolvencies is high, expected to increase further in the coming six months.

United Kingdom

Retailers need to cut costs amid volatile consumer confidence

After a 1.2% growth in 2025 we expect consumer durables sales in the UK to contract by 1.1% in 2026. UK Consumer confidence remains volatile amid lower pay growth and higher inflation.

Companies have cut spending on wages and salaries in response to the increase in employers' national insurance contributions (NICs) in April. Retailers face the need to cut costs, while opportunities for top line growth are limited.

Credit risk in the segment remains elevated, and maintaining strong liquidity discipline through stock and supply chain management will be critical for success. Smaller players struggle most in a shrinking market, as many are unable to access more favourable pricing and payment terms.

Interested in finding out more?

Download the full report in the related documents section below for a detailed analysis of the challenges, performance, and credit risks facing the consumer durables/retail industry’s major markets throughout the world.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us to see how we can help you stay ahead.

- After increasing by 5.8% in 2024, global sales growth of consumer durables is forecast to slow down to 1.8% in 2025 and 1.3% in 2026

- Currently the most imminent threats are the increased use of trade tariffs and protectionism

- United States: Solid growth outlook in 2026, but tariffs threaten supply chains

- China: consumer durables sales growth to slow down to 0.6% in 2026

- France/Germany/UK: Credit risk remains high in the consumer durables retail sector

Rückruf anfragen

Sprechen wir darüber, wie wir Sie in Ihrem Risk Management unterstützen können.

Rechtlicher Hinweis